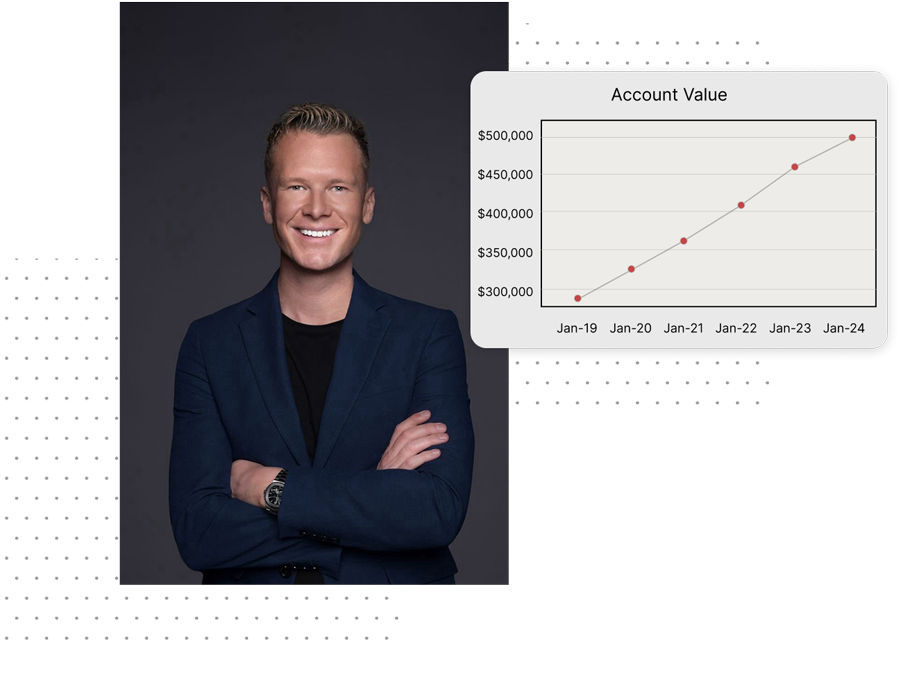

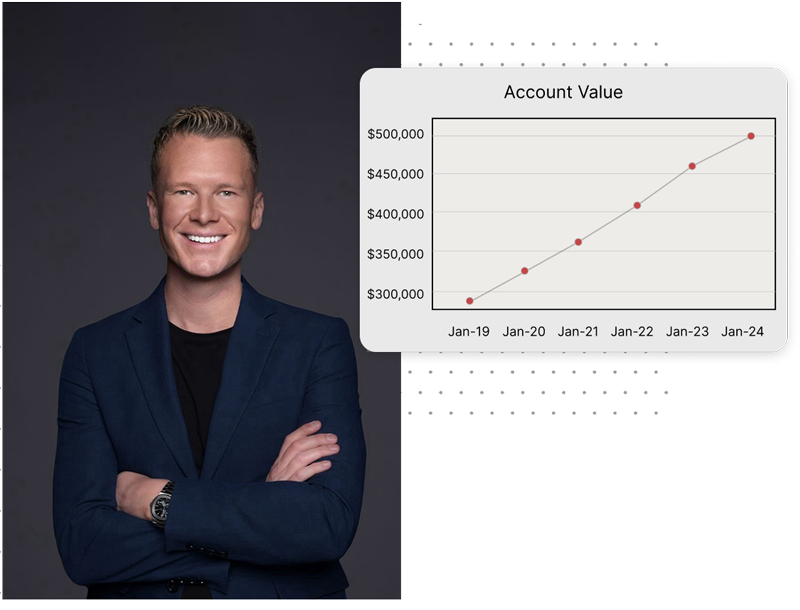

GET YOUR CAPITAL WORKING TODAY

- $50,000 Minimum

- 12% Return Annually

- 1% Paid Monthly

- 24 Month Commitment

Our newly created private loan investment strategy has been created to offset the higher risk offerings of today's economy and is designed to focus on delivering strong returns with an easy to understand program and risk profile.

Why private debt

In a move not seen in decades, The Federal Reserve has escalated the cost of borrowing at a rapid pace over the last two years, aiming to control inflation and the rising prices throughout the economy. This change in strategy has caused market instability, resulting in widespread disruptions, heightened tension throughout the system, and a possible cash flow problem that could jeopardize the world’s financial health. At the same time, these elements have collectively formed what we consider to be one of the most favorable conditions for investing in debt securities in recent decades.

Private Debt is a type of asset that typically includes loans or fixed-income security investments. The purpose of Private Debt is to provide higher than average returns as it does not offer liquidity but with less risk compared to equity investments. Essentially, investors lend money to borrowers and receive a fixed rate of return and do not have any equity in the asset.

In this phase of our economy, those who need to borrow money will be required to do so under terms that are much more beneficial to investors. The higher interest rates cause a higher monthly cost leading to a lower leverage of the asset, this lower leverage translates to lower risk to the lender.

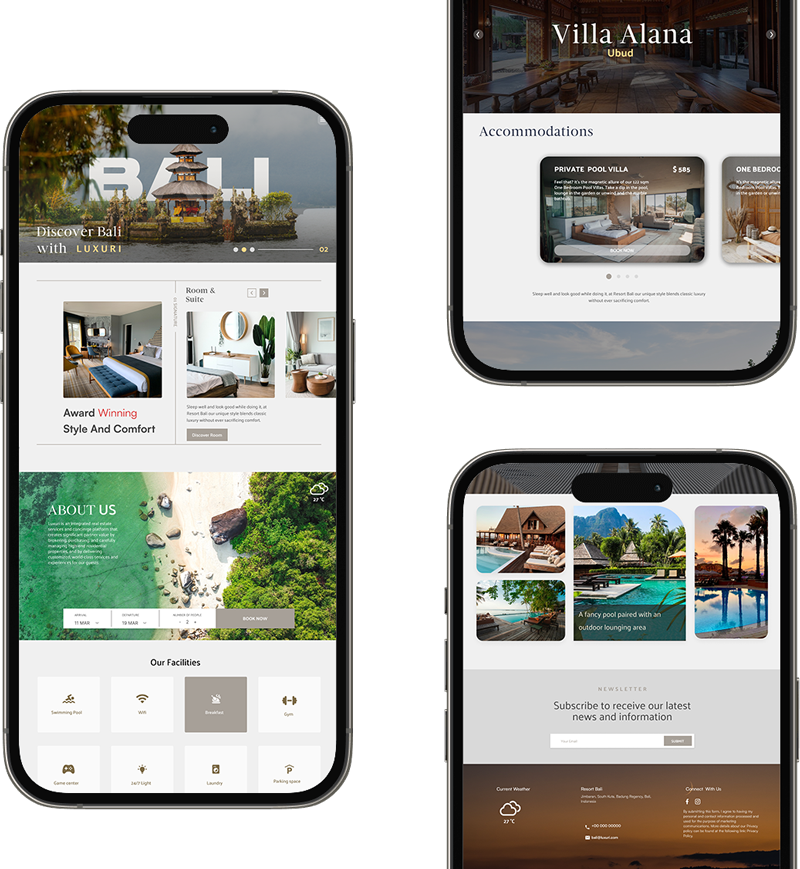

With Luxuri Lending, investors are making loans directly to our company, from here we lend the funds to our projects or other investments and pay the investor their monthly interest payment. Investor funds are protected with our company as Luxuri Lending guarantees your monthly return and the return of the initial loan amount in a balloon payment when requested.

Luxuri Lending provides investors a better than market return with a flat simple interest of 12% per annum on any loan amount. Loans are a minimum of 24 months and the balloon payment continues to float month to month. After the initial 24 months, an investor can request their balloon payment or any amount of their initial loan to be returned though a simple 60 day request.

The Federal Reserve has created opportunities that are distinctive in the sense that they affect almost every loan or debt recipient irrespective of their credit worthiness. Regardless of whether you’re a consumer or an investor, if you’ve been participating in any economic activities in recent years, you’ve undoubtedly incurred some type of debt. This debt has been at a significantly higher rate reducing your ability to buy. Luxuri Lending is the bridge between Investor Equity and Typical Mortgages. We can lend on all asset types and fill the space left by the lower leverage loans available on the market today.